The Great Tokenization Unbundling: Why Specialized RWA Chains Will Outperform 'One Blockchain Fits All' Approaches

In the rapidly evolving landscape of tokenized assets, a seismic shift is underway that challenges conventional blockchain wisdom. For too long, the industry has pursued the holy grail of a single, universal blockchain capable of handling everything from NFT collectibles to complex financial instruments. But as the tokenization of Real World Assets (RWAs) accelerates, this 'one size fits all' approach is revealing critical limitations.

Let me offer a contrarian perspective: specialized RWA chains like RedBelly Network aren't just an alternative approach—they represent the inevitable future of serious asset tokenization. After all, you wouldn't use the same tool to fix both your watch and your car, so why use the same blockchain?

The Scalability Trilemma: An RWA-Specific Challenge

The blockchain industry has long grappled with the infamous scalability trilemma—the challenge of simultaneously achieving security, decentralization, and scalability. General-purpose blockchains like Ethereum have made valiant attempts to balance these competing priorities, but RWA tokenization introduces a fourth dimension that upends this delicate equilibrium: regulatory compliance.

When tokenizing real-world assets worth billions of dollars, the stakes become exponentially higher. Suddenly, the trilemma transforms into a quadrilemma, with compliance requirements that cannot be compromised. This fundamental shift demands purpose-built infrastructure rather than retrofitted solutions.

Think of it this way: trying to tokenize complex financial instruments on general-purpose chains is like attempting to perform heart surgery with a Swiss Army knife—technically possible, but nobody in their right mind would choose it if a specialized surgical toolkit were available.

The Regulatory Reality Check

The regulatory landscape for RWAs is fundamentally different from that of purely digital assets. General-purpose blockchains typically handle regulatory compliance as an afterthought—a layer bolted on top of the core protocol, usually managed off-chain by third parties.

This approach might work for digital collectibles, but it fails spectacularly for securities, real estate, or carbon credits that must comply with complex regulatory frameworks spanning multiple jurisdictions. The consequences of compliance failures aren't just theoretical—they can result in securities law violations, frozen assets, and legal liability.

RedBelly Network's approach fundamentally inverts this paradigm. Rather than treating compliance as an afterthought, it builds verifiable credentials and regulatory guardrails directly into the protocol layer. This purpose-built approach ensures that compliance isn't just a feature—it's the foundation.

As one financial regulator (who shall remain nameless) recently told me: 'We don't care about your blockchain's TPS if you can't tell us who owns what.' Harsh, perhaps, but impossible to argue with.

The Technical Divergence: SuperBlocks vs. Generalized Architecture

RedBelly's Superblock architecture represents a fundamentally different approach to the scalability challenge. Unlike general-purpose chains that scale by sacrificing either security or decentralization, RedBelly's patent-pending collaborative consensus technology allows nodes to merge transactions into 'superblocks,' dramatically increasing efficiency without compromising on security.

This specialized architecture delivers several critical advantages for RWA tokenization:

- Deterministic Finality: Transactions achieve true finality in sub-second timeframes, eliminating settlement risk for high-value assets.

- High Throughput: The network can process up to 23,000 transactions per second—essential for managing complex structured products with multiple asset components.

- Built-in Accountability: The architecture incorporates verifiable identity at the protocol level, ensuring regulatory compliance without sacrificing performance.

These aren't just incremental improvements—they represent a fundamental rethinking of blockchain architecture for RWA applications. While general-purpose chains continue optimizing for broad use cases, specialized RWA chains are pushing boundaries in areas that matter specifically for tokenized assets.

The Proof is in the Partnerships

The market is already validating this specialized approach. RedBelly Network has secured partnerships representing over $73.8 billion in tokenization pipeline, including:

- Hutly's tokenization of $1.8 billion in rent rolls

- Liquidise's tokenization of $500 million in private equity

These aren't speculative projects or proofs-of-concept—they're commercial implementations with real capital at stake. The reason these significant players are choosing specialized RWA chains isn't technological favoritism; it's simple pragmatism. Purpose-built infrastructure delivers tangible advantages that directly impact their bottom line.

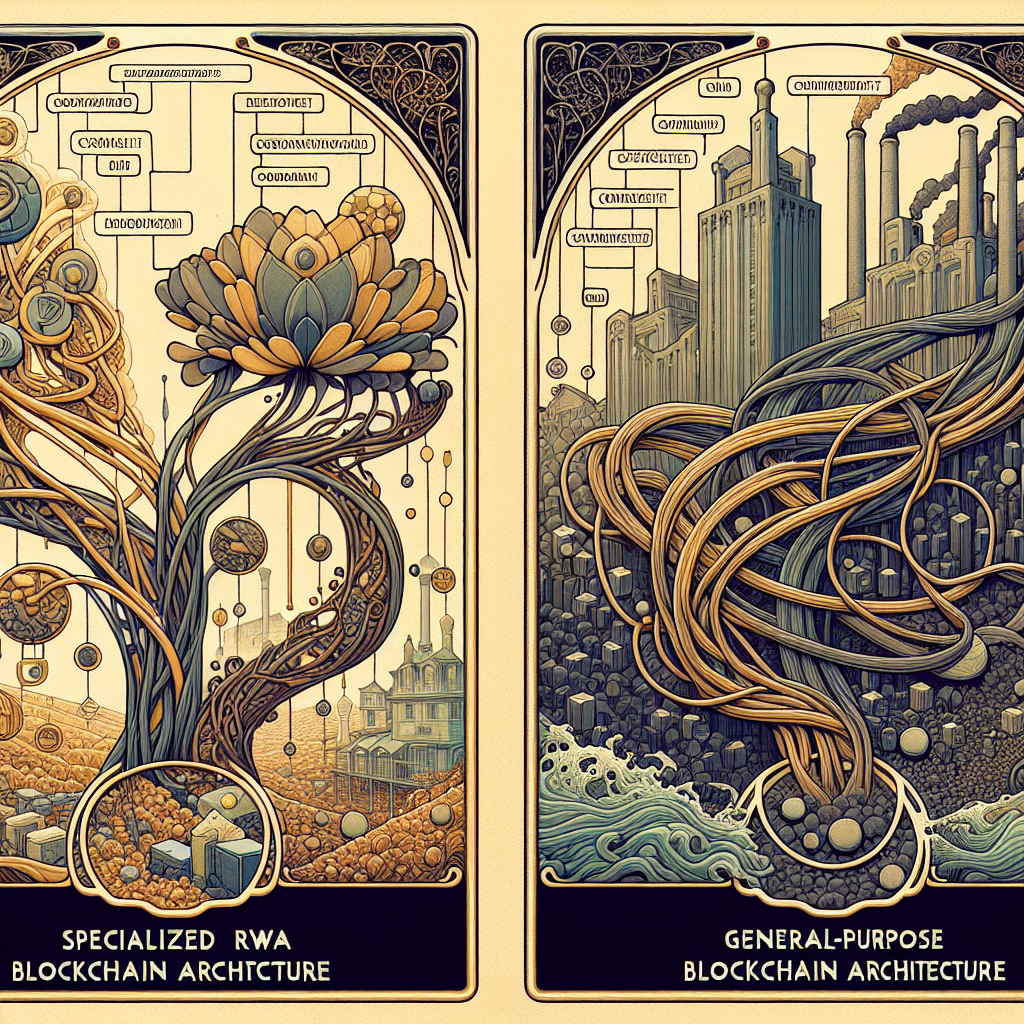

The Unbundling of Tokenization Infrastructure

What we're witnessing isn't just a technical shift—it's the beginning of a comprehensive unbundling of blockchain infrastructure. Just as the financial services industry evolved from universal banks to specialized institutions, blockchain infrastructure is following a similar evolutionary path.

This unbundling creates distinct advantages:

- Optimized Performance: Chains can optimize for the specific requirements of their target asset class rather than compromising to accommodate diverse use cases.

- Regulatory Alignment: Specialized chains can align precisely with the regulatory frameworks governing specific asset classes.

- Industry-Specific Features: Purpose-built chains can incorporate features relevant to specific industries, such as carbon credit verification or real estate title transfers.

The future of tokenization isn't a single universal blockchain—it's an ecosystem of specialized chains optimized for specific asset classes and use cases, interconnected through cross-chain protocols.

And let's be honest: if you're issuing a multi-million dollar tokenized security, would you rather use infrastructure designed specifically for that purpose, or a platform where your transaction might be delayed because someone's paying too much for a JPEG of a bored primate? I thought so.

The Path Forward: Specialized Expertise

For RWA issuers, the implications are clear: the choice of blockchain infrastructure is now a strategic decision that directly impacts regulatory compliance, operational efficiency, and market access.

The advantages of specialized RWA chains include:

- Regulatory Certainty: Purpose-built compliance features reduce regulatory uncertainty and liability.

- Operational Efficiency: Specialized infrastructure streamlines issuance and management processes.

- Market Access: Purpose-built networks facilitate connections to relevant liquidity pools and institutional investors.

As the RWA tokenization market matures, we'll see increased specialization within the category itself—chains optimized for real estate will differ from those designed for carbon credits or structured products.

Conclusion: The End of the Universal Blockchain Dream

The dream of a single, universal blockchain capable of handling every conceivable use case was compelling, but ultimately unrealistic. Just as specialized tools outperform Swiss Army knives for specific tasks, specialized blockchain infrastructure will inevitably outperform general-purpose chains for RWA tokenization.

RedBelly Network's approach—purpose-built for RWA tokenization with integrated compliance, deterministic finality, and high throughput—represents the future of serious asset tokenization. As the market matures and tokenization volumes increase, the advantages of specialized infrastructure will become increasingly apparent.

The great tokenization unbundling has begun, and specialized chains are positioned to capture the most valuable segments of the market. General-purpose chains will continue to serve important functions in the broader blockchain ecosystem, but the future of RWA tokenization belongs to purpose-built infrastructure.

After all, you wouldn't perform heart surgery with a Swiss Army knife—and you shouldn't tokenize billions in real-world assets on a blockchain designed to handle digital collectibles. Some tools are simply better suited for the job.