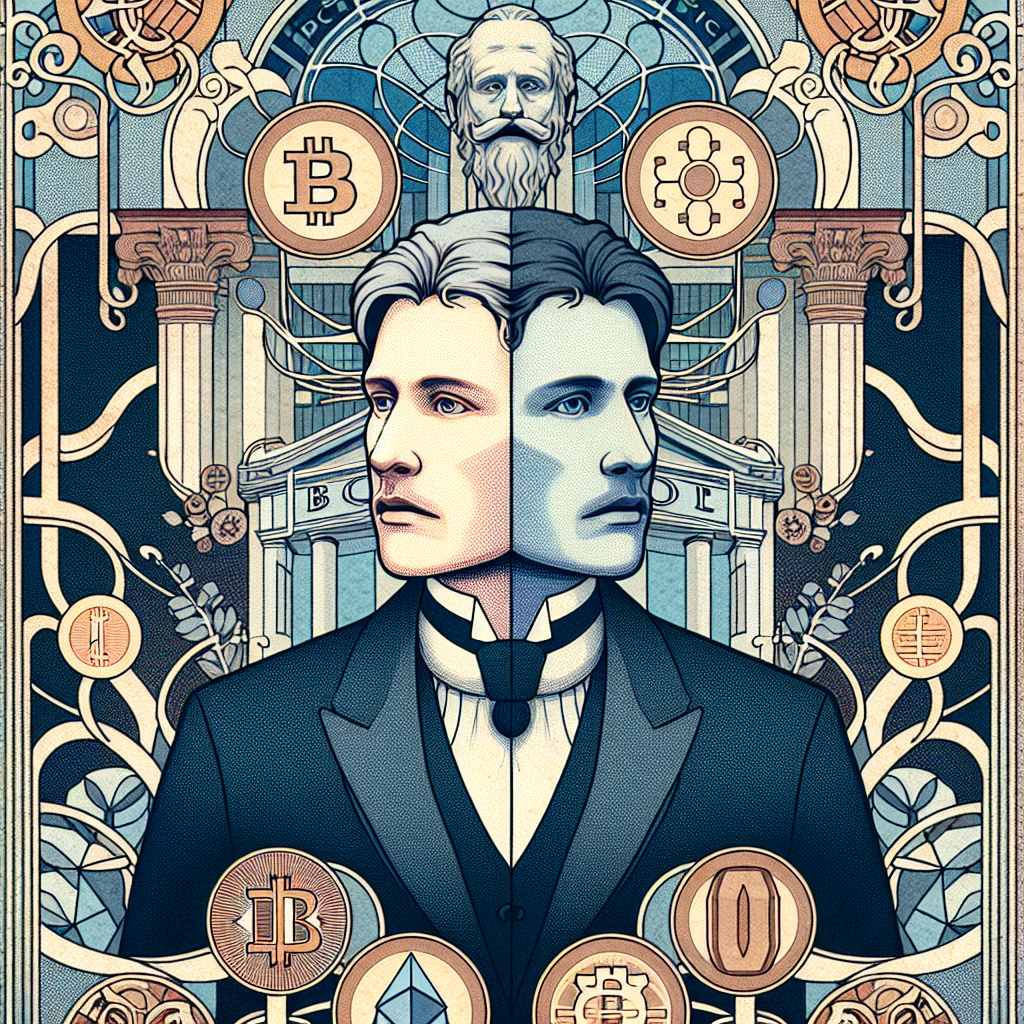

The Banking Industry's Two-Faced Approach: Criticizing Crypto While Quietly Building RWA Empires

In the grand theater of global finance, major banks have perfected the art of saying one thing while doing another. Nowhere is this corporate doublespeak more evident than in their approach to cryptocurrency and blockchain technology.

While bank executives publicly denounce crypto as speculative, dangerous, or even fraudulent, their institutions are quietly filing blockchain patents, posting job listings for tokenization experts, and building sophisticated infrastructure for the very technology they claim to distrust.

The Public Face: Crypto Skepticism

Listen to any major banking conference, and you'll hear variations of the same cautious refrain:

'Cryptocurrency lacks intrinsic value.'

'Blockchain is a solution looking for a problem.'

'Digital assets pose significant regulatory and reputational risks.'

These institutions cite concerns over illicit finance, money laundering, and reputational damage to justify their public skepticism. And to be fair, these aren't entirely unfounded concerns. But they tell only half the story.

The Private Reality: Blockchain Patent Empires

While bank CEOs were giving interviews about crypto's dubious future, their legal departments were quietly amassing impressive portfolios of blockchain-related intellectual property:

- Bank of America holds over 80 blockchain-related patents, making it one of the financial industry's leaders in blockchain IP

- JPMorgan Chase has extensively developed Onyx, a dedicated blockchain division exploring tokenized deposits

- Goldman Sachs has filed patents for a 'digital assets platform' while simultaneously providing tokenization services to institutional clients

The cognitive dissonance is almost admirable in its audacity. It's rather like watching someone loudly proclaim the dangers of sugar while secretly building the world's largest candy factory. You almost have to respect the sheer commitment to the contradiction.

The Evidence: Following the Money (and the Job Postings)

The financial industry's true intentions become remarkably clear when you examine three key indicators: their patents, their job postings, and their strategic investments.

The Patent Gold Rush

Major financial institutions have been aggressively patenting blockchain technology for years. Bank of America's 80+ blockchain patents cover everything from cryptocurrency transaction validation to digital asset storage solutions. These aren't defensive patents—they're the foundation for future business models.

JPMorgan Chase isn't far behind, with patents related to its blockchain-based Liink network and JPM Coin. Even Goldman Sachs, despite its executives' public skepticism, has filed patents for comprehensive digital asset trading platforms.

Hiring Sprees for a Technology They 'Don't Believe In'

Job boards tell an even more revealing story. In 2024-2025, major banks have been quietly but aggressively recruiting blockchain developers, tokenization specialists, and digital asset experts. A quick search reveals hundreds of banking blockchain positions on Indeed.com alone.

UBS is actively recruiting for its UBS Tokenize division, while even traditional banks like BNY Mellon advertise for blockchain experts to support their 'digital asset platform.' These aren't exploratory positions—they're mission-critical roles for technologies these same institutions publicly downplay.

I find it particularly amusing that some job descriptions require 'experience explaining blockchain benefits to traditional finance stakeholders'—essentially hiring people to convince their own colleagues that the technology is worthwhile. It's organizational cognitive dissonance at its finest.

Strategic Investments Reveal True Intentions

Perhaps most telling are the strategic blockchain projects major banks have launched or joined:

- Fnality International: A consortium including Santander, HSBC, Barclays, and UBS working on tokenized central bank money

- JPMorgan's Liink: A blockchain network with over 400 financial institutions participating

- Project Agora: Led by HSBC and BNP Paribas to tokenize trade assets

- Canton Network: SIX, Deutsche Börse, and Goldman Sachs building infrastructure for tokenized markets

- Versana Platform: J.P. Morgan, Bank of America, Citi and other major players transforming syndicated loans through tokenization

These aren't speculative ventures—they're sophisticated enterprise blockchain solutions addressing real financial market inefficiencies through tokenization.

The Strategy: Why Play Both Sides?

So why maintain the skeptical public façade while actively building blockchain empires? Several strategic advantages come to mind:

1. Regulatory Positioning

By publicly distancing themselves from crypto's volatile reputation, banks create breathing room with regulators while developing compliant infrastructure. When regulations eventually catch up, they'll be perfectly positioned with ready-to-launch products.

2. Competitive Advantage

Downplaying blockchain's potential while quietly building expertise creates a competitive moat. By the time most competitors realize the technology's transformative potential, established banks will have already secured key patents, talent, and infrastructure.

3. Market Control

Perhaps most importantly, banks are ensuring that when RWA tokenization goes mainstream, it happens on their terms. They're building private, permissioned blockchain networks that preserve their role as gatekeepers—a far cry from crypto's decentralized ethos.

It's rather like criticizing the concept of automobiles while secretly building the highways they'll drive on. When the inevitable transition happens, guess who controls the infrastructure?

Real-World Assets: The Trojan Horse

The focus on tokenizing real-world assets reveals banks' true strategy. Unlike volatile cryptocurrencies, RWAs provide a regulated, compliant entry point into blockchain technology.

By tokenizing traditional assets like bonds, real estate, and commodities, banks can embrace blockchain's efficiency benefits while maintaining control over the underlying assets. It's blockchain adoption without the decentralization—all the technological benefits with none of the disruption to their business models.

Projects like Visa's Tokenized Asset Platform (VTAP), which helps banks issue fiat-backed tokens, show how this strategy is already unfolding. Banks get to preserve their central role while adopting the technology that threatened to disintermediate them.

The Future: Inevitable Convergence

As we look toward 2026 and beyond, the banking industry's two-faced approach to blockchain will become increasingly difficult to maintain. Several trends suggest an inevitable convergence:

- Regulatory frameworks for digital assets are maturing globally

- Client demand for tokenized assets is accelerating

- The efficiency benefits of blockchain infrastructure are becoming impossible to ignore

We're likely approaching an inflection point where major banks will pivot from crypto skeptics to blockchain champions—rewriting history to position themselves as forward-thinking innovators rather than reluctant adopters.

When that happens, remember this moment—when banks were building the future they publicly claimed to doubt.

The Bottom Line

The next time you hear a banking executive dismiss crypto or blockchain technology, remember that actions speak louder than words. While their public relations departments craft careful statements of skepticism, their patent attorneys, hiring managers, and strategic investment teams are telling a very different story.

In the ultimate corporate 'do as I say, not as I do' scenario, major banks are positioning themselves to dominate the very technology they publicly criticize. They don't want to eliminate tokens—they want to control them.

And perhaps that's the most honest approach after all. In the battle between innovation and self-preservation, banks have found a third path: embrace the technology, reject the ideology, and ensure they remain at the center of whatever financial system emerges.

Just don't expect them to admit it quite yet.